does new mexico tax pensions and social security

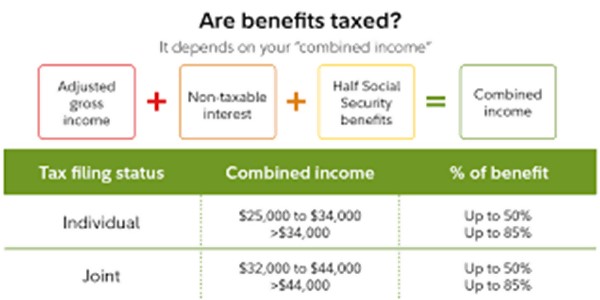

Dont include any social security benefits unless a you are married filing a separate return and you lived with your spouse at any time in 2021 or b one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than 25000 32000 if. Same goes for Social Security benefits.

Tax Withholding For Pensions And Social Security Sensible Money

No New Hampshire tax on them.

. Proof of Social Security Number. The social security shares payable by the employer and the employee are tax-deductible items in their respective PIT settlements. The employee then pays tax only on salary net of.

Tax relief on pension contributions may be given in two ways. Your tax rate would probably be more like 15-25 of your benefits. Social Security only counts income from employment towards the retirement earnings testOther kinds of income including income from rental properties lawsuit payments inheritances pensions investment dividends IRA distributions and interest will not cause benefits to be reduced.

Before tax has been deducted. For 2022 theres a. New Mexico offers a tax deduction of up to 8000 to taxpayers age 65 or older depending on income.

As of 1st January 2022 according to the new regulations introduced by the Polish Deal the amount of 775 of the health insurance assessment base is no longer tax deductible thus the 9of contribution rate for. _ _ _ _ 2021 pit-b 210590200 page 2 new mexico allocation and apportionment of income schedule your social security number business name business tax identification number g. You can receive full benefits from both.

Those with higher incomes where 85 of your benefits would be taxed might pay a tax of 28 on their benefits. Nmbtin worksheet for apportionment of business and farm income complete a worksheet for each business or farm. H Dependent information see page 14 First name MI Last name Relationship If more than 7 dependents mark an X in the box.

A copy of a government-issued photo ID. In 2022 Social Security withholds 1 in benefits for every 2 earned. Free printable and fillable 2021 New Jersey Form NJ-1040 and 2021 New Jersey Form NJ-1040 Instructions booklet in PDF format to fill in print and mail your state income tax return due April 18 2022.

Taxation of Social Security Disability Backpay. Net pay or relief at source. Social Security benefits are also.

Chinas pension system has undergone radical transition from the state-employer model to a state-society one based on the combination of an underlying aim of supporting the economic reforms and learning from international. In other words your tax rate would not be 50 or 85 of your benefits. For original owners or people claiming on behalf of original owners New Mexico requests that claimants submit the following evidence.

A signed and notarized claim form. In a net pay scheme contributions are deducted from the employees gross salary ie. The SSA does not include IRAs pensions interests annuities or dividends as part of your earnings.

The tax rate is the same used for your other income. Your Social Security benefit is not reduced by your military benefits. How to Contact the Social Security Administration.

If I take money out of my IRA will it affect my Social Security benefit. Proof that you lived at or received mail at the address associated with the property. This article is the first examination of pension reform in China and its effects on different social groups over the past three decades.

201001210094 For office use only Social Security number Date of birth mmddyyyy Page 2 of 4 IT-201 2021 Your Social Security number Federal income and adjustments see page 14 Whole dollars only 1 Wages salaries tips. Social Security benefits are paid out monthly to retired workers and their spouses who have during their working years paid into the Social Security system. Social Security Benefits.

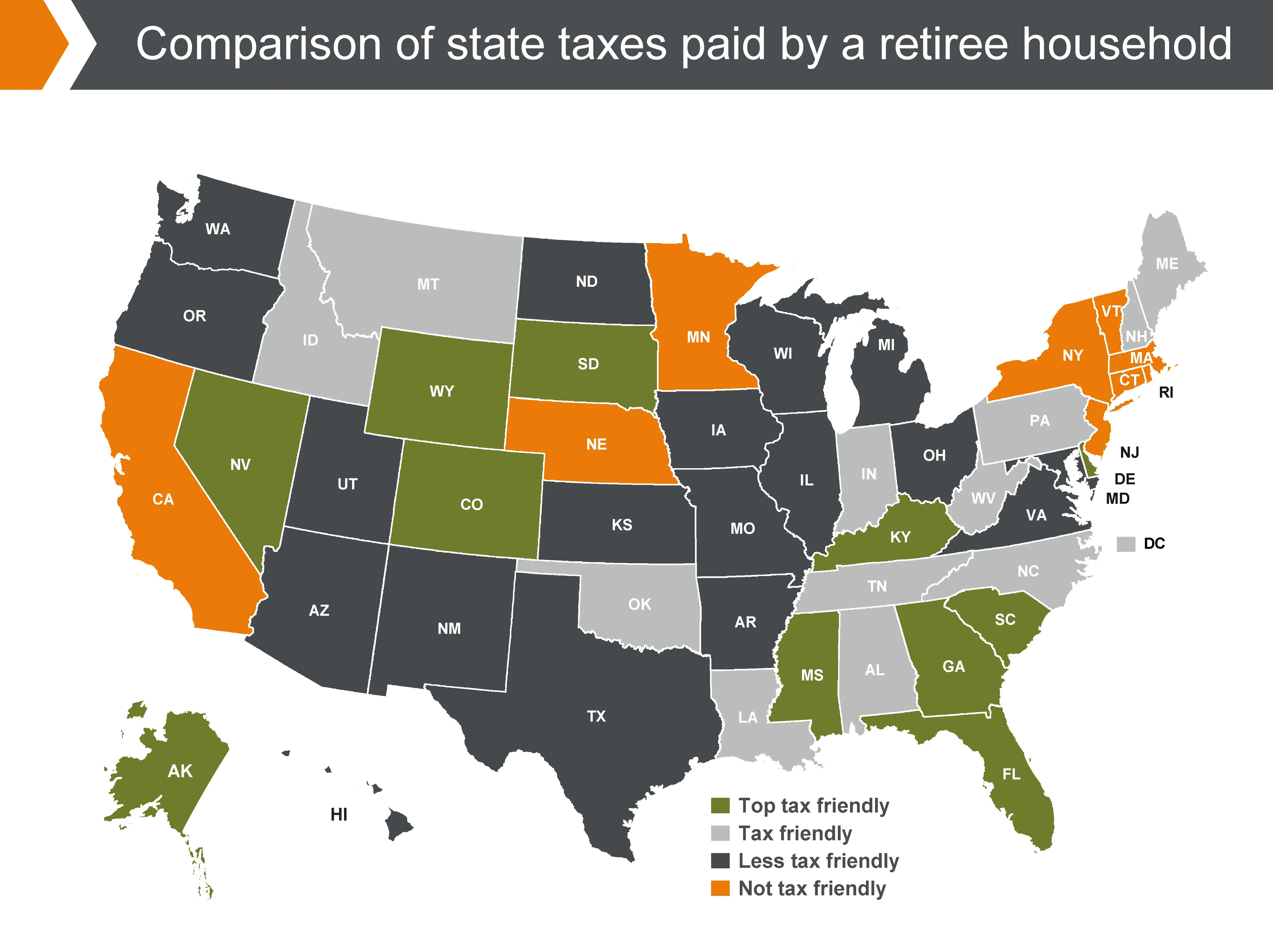

14 _ _ _. Rhode Island provides various tax breaks for Social Security as well as provisions for pension income military retirement pay and retirement funds including 401k and 403b accounts.

Tax Withholding For Pensions And Social Security Sensible Money

How Do Dividends Affect Social Security Benefits Intelligent Income By Simply Safe Dividends

New Mexico Retirement Tax Friendliness Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Taxation Of Social Security Benefits Mn House Research

New Mexico Retirement Tax Friendliness Smartasset

Taxation Of Social Security Benefits Mn House Research

How Taxes Can Affect Your Social Security Benefits Vanguard

Bill To Cut Social Security Taxes Heads To Governor S Desk In New Mexico Thinkadvisor

Retirement These 13 States Tax Your Social Security Money Gobankingrates

A Closer Look At Social Security Taxation Jim Saulnier Cfp Jim Saulnier Cfp

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

New Mexico Retirement Tax Friendliness Smartasset

New Mexico Eliminates Social Security Taxes For Many Seniors Thinkadvisor

States With The Highest And Lowest Taxes For Retirees Money

Social Security Income Tax Exemption Taxation And Revenue New Mexico

37 States That Don T Tax Social Security Benefits The Motley Fool

.jpg)

Don T Want To Pay Taxes On Your Social Security Benetfit Here S Where You Should Move To